Since 1998 we have been serving the automobile industry

with our exclusive Car Dealer Electronic Debit and

Credit Card Processing Program: Auto Dealer Platform®

The Auto Dealer Platform is a trademarked set of features and software options developed and marketed to support new car dealers.

Long before other processor’s copied us, we diagnosed the needs of the new car auto dealer and built innovative merchant processing software combinations that specifically target an auto dealer’s needs.

Our Exclusive Debit and Credit Card Program Helps Service Managers and Advisors

As Service Manager, ensuring the profitability of your dealership is a big responsibility that encompasses many roles and functions. Among many others, you coordinate and motivate the management in your various departments. Our Auto Dealer Platform® is a great tool for your business and service managers. This indirectly helps you by improving their performance, but it also provides direct benefits for you, including:

Our payment system integrates with most DMS providers

Cloud-Based

Cloud-Based

Our cloud‐based, credit card processing program allows multiple transaction types while simplifying reports and oversight tasks for management.

Because it is cloud‐based, not browser or web page dependent, lost time and frustraon due to time‐outs (as common with virtual terminals) are eliminated. Using your own Windows® PC or laptop, the program is easily downloaded and setup and we’re always available to help with any questions. Once installed and activated, the keypad is simple to learn and operate. After connecting the computer to a swipe device and PIN pad, most transactions are easily completed.

An unlimited number of licenses are possible so all your advisors can be setup at their stations.

Four important ways we can help with customer relations:

- Ease of use for advisors

- Billing review with customers

- Accept Cash/Checks/Credit Cards EPNJPOS devices

- Swipe or key the credit card

With us, any or all of the following transactions are possible:

- Swiped or keyed credit card

- PIN debit

- Refunds, voids, and auth only

- Cash

- Checks

- Signature capture (mobile only)

Your content goes here.

Your content goes here.

Two More Reasons To Choose Auto Dealer Platform

1. We make sure you get the best possible service and support

At Auto Dealer Platform, we work hard to ensure you are getting the best possible service and support – seven days a week – 24 hours a day.

No Hassle Installation and Setup

If you’re accepting credit/debit cards, you need the proper equipment. For many items, especially point-of-sale terminals, the equipment is shipped with no software or initial data. Most other companies leave it completely up to the merchant to do all the work of contacting support, downloading the necessary software features, and then performing the installation and setup. Since most merchants are not IT specialists nor can they afford to contract one, this can be a time-consuming and frustrating process.

Auto Dealer Platform eliminates the frustration and hassles. Rather than shipping the terminals directly to you, we have them shipped to our offices first. Then we download all the necessary software features (based on our discussion with you), install them, and then perform a complete system test to ensure everything is working correctly.

Your equipment is then shipped to you fully configured for plug-and-play operation. Auto Dealer Platform wants you to be 100% satisfied with your new equipment and its configuration. To ensure this, once your equipment is received, installed, and operating, we always call you after your first and second days of credit card processing to discuss operation, make sure you have no problems, and answer any questions.

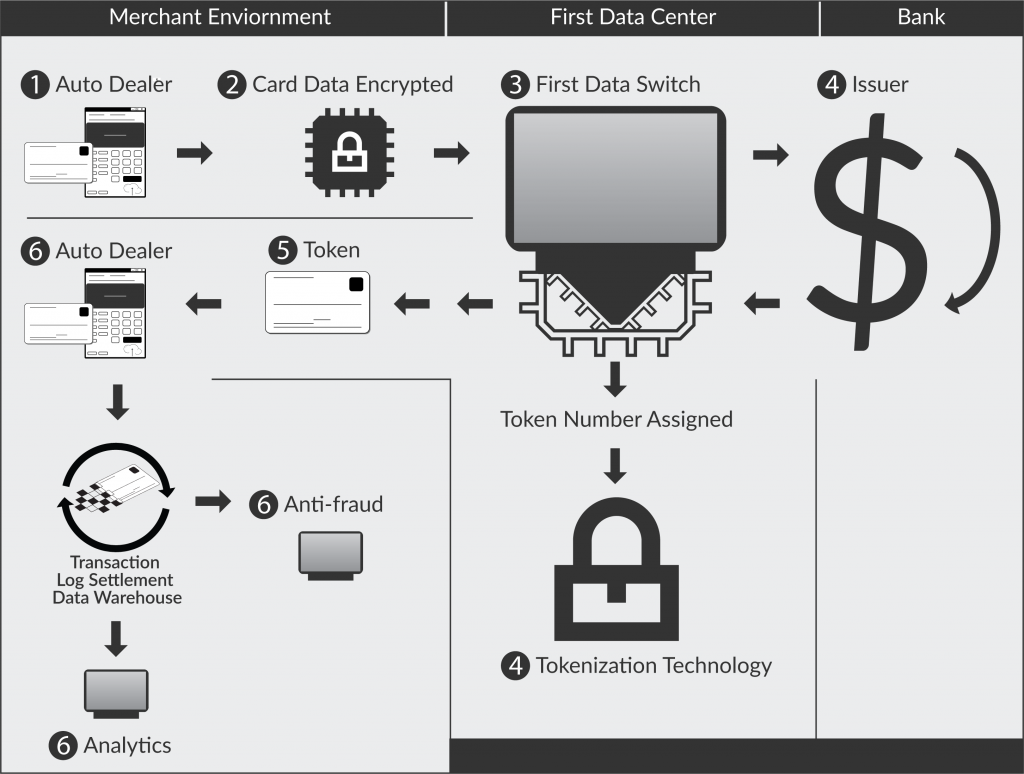

2. Raising the Bar on Security: Multi-layered, Payment

Card Data Security with TransArmor®

Auto Dealer Platform ensures all your terminals are enabled for TransArmor. TransArmor combines the flexibility of software- or hardware-based data encryption with random number tokenization. This provides a one-two punch that protects payment card data at every transaction stage—in transit, in use, and at rest—while reducing the challenge and expense of Payment Card Industry Data Security Standard (PCI DSS) compliance.

As is well documented in the media, data breaches are on the rise and criminal focus has recently shifted. Criminals are no longer targeting large corporations and institutions attempting to steal millions of accounts containing credit card and other identity information. The trend now is to attack smaller businesses and organizations. This yields smaller numbers of cards, but small business usually cannot afford enterprise level protection. With TransArmor, you now have world-class protection for your clients’ credit card data.

Visit TransArmor In-Site for detailed information and tools to help better understand and utilize the power and security of TransArmor

How the TransArmor solution works:

- The consumer provides their card number for the auto dealer’s point-of-sale terminal

- The card data is then encrypted and transmitted to our processor’s front-end

- The front-end decrypts the data payload

- Card data is sent to the issuing bank for authorization and, in parallel, tokenized

- The token is paired with the authorization response and sent back to the auto dealer

- The utility stores the token instead of the card data in their environment and uses the token for subsequent business processes.